Good Reasons For Deciding On Forex Trading Macryt

-

FrankJScott

- Posts: 2316

- Joined: 07 Aug 2021, 20:09

- Location: Best Mastiff Breeds

- Contact:

Good Reasons For Deciding On Forex Trading Macryt

What Exactly Is Automated Trading In Crypto? What Strategies And Tactics Can One Use To Achieve It?

Automated crypto trades refer to the application of algorithms or computers for executing trades in the market for cryptocurrency. These programs are designed to adhere to specific rules of trading in order to maximize profits while keeping losses to a minimum.

It is important to choose an automated trading platform that you can be confident about: There are a variety of trading platforms available. It is crucial to choose an automated trading program with a solid track record and is able to meet the requirements of your trading.

A strategy for trading is vital prior to automating your trading. This includes identifying the market conditions in which you want to trade, deciding on exit and entry points, and setting stop-loss order.

Use a risk management system: A good automated trading system will include a risk management system to reduce the chance of losses. This could include placing stop loss orders, and limit the amount of trades that can be made at any given period of time.

Before you implement your strategy for live trading it is essential to test it on previous data. This will help you discover any flaws in your strategy and make necessary adjustments.

Automated Trading System Monitoring: Although automated trading may save time, it is important to keep an eye on the system, and make changes as necessary.

Keep abreast of market conditions. To be successful with automated crypto trading, you must be aware of the market conditions. You can modify your strategy in line with market conditions.

Consider using a diversified portfolio It is possible for cryptocurrency markets to be unstable, and it's possible to have a diverse portfolio of cryptocurrencies , and/or other investments to spread out risk and maximize potential profits.

Overall, successful automated cryptocurrency trading is a result of dependable software, a clearly-defined trading strategy, effective risk management, ongoing monitoring and adjustments, as well as the consideration of a diverse portfolio. Take a look at the most popular backtesting for blog advice including forex robot forum, binance auto sell, shrimpy crypto, free automated trading, binance exchange fees, bybit exchange, kairos automated trading platform, samtrade fx reddit, algo auto trading, options for crypto, and more.

How Do The Automated Trading Software's Cryptocurrency Trading Bots Function?

Following predefined rules, trading robots for cryptocurrency execute trades on behalf users. Here's how it works trading strategy: The user defines the trading strategy that they want to follow, which includes entry and exit rules, position sizing, and risk management rules.

Integration: The bot for trading integrates with an exchange for cryptocurrency via APIs, allowing it to get access to live market data and execute trades.

Algorithms analyze market data to make trading decisions based in part on a particular strategy.

Execution. With no requirement to manually control the process the bot is able to execute trades according to the trading strategy's rules.

Monitoring: The robot continuously analyzes market activity and changes trading strategies according to the need.

The use of trading robots for cryptocurrency is beneficial when executing complex or routine trading strategies. This makes it less necessary to intervene manually and allows traders to profit from market opportunities 24 hours a day. It is important to recognize that automated trading has its own set of risks, including the potential for software malfunctions as well as security flaws, as well as losing control over trading choices. Before you decide to use any bot to trade live trading, it is important to fully evaluate and test it. Follow the top crypto trading bot tips for more examples including forex and crypto, tastytrade forum, automated fx, elite traders reddit, cheapest fees crypto exchange, best autotrading platform, crypto spot, primexbt welcome bonus, ninjatrader 8 automated trading strategies, best forex robots mt4, and more.

What Is The Crypto Trading Backtester? How Do You Use It In Your Strategy?

The backtester for crypto trading allows you to test your strategy for trading against the historical prices in order to see how it has did over time. It is a useful tool for evaluating the effectiveness of a trading strategy , without placing a bet on money.To include a cryptocurrency backtester for trading into your strategy, you should take these steps:

Select a site for backtesting There are a variety of platforms that allow you to backtest strategies to trade with crypto. These include TradingView (Backtest Rookies), TradingSim, and TradingSim. Select the best platform for you and your budget.

Define your trading strategy Before you are able to back-test your strategy you must define the guidelines you'll apply to entering and exiting trades. This could include indicators of technical nature such as moving averages, Bollinger Bands, or RSI in addition to other criteria like trading volume, news events, or sentiments on social media.

Start the backtest. After you've created your trading plan, it's possible to setup the test on the platform you prefer. This requires you to select the cryptocurrency pair you'd like to test and the time period you want to test it, and any other parameters related to your plan.

To determine how your trading strategy worked over time, run the backtest. Backtesters will produce reports that detail the outcomes of trades including profit and losses, loss/win ratios, and other metrics.

Examine the results: You can analyze the results following the test to find out how your strategy performed. The backtest results can help you adjust your strategy to increase its effectiveness.

Test the strategies forward: After making any adjustments to the strategy, you can test it forward strategy using an example or a small amount of real money. The method will then work in real-time trading conditions.

By incorporating the backtester for crypto trading into your strategy, you can gain valuable insights into how your strategy might have performed in the past and then apply this knowledge to improve your trading strategy going forward. View the top best trading platform tips for site recommendations including 3commas indicators, pepperstone automated trading, best trading forums reddit, shiba coin exchange, cryptocurrency trading sites, free day trade chat rooms, mt4 forum forex, best crypto trading platform reddit, best platform for crypto, fibonacci cryptocurrency, and more.

How Can You Evaluate The Results Of Backtesting To Assess The Risk And Profitability Associated Trading Strategies?

Analyzing the results of backtesting will help you determine the profit and risk associated to a trading strategy. Here are some steps to follow when analyzing backtesting results Determine performance metrics The first step to take when analysing backtesting results is to determine key performance indicators like the return on investment, average return, maximum drawdown, and Sharpe ratio. These metrics give insight into the risk and profitability associated with the strategy of trading.

Comparing to benchmarks. A comparison between the benchmarks and performance indicators (e.g. the S&P 500) can be an excellent reference point to see how the strategy has performed relative to the other markets.

Evaluate risk management practices Examine the risk management strategies that are employed within the trading strategy such as stop-loss orders or positioning sizing to determine their efficiency in reducing loss.

Find trends: Examine the effectiveness of the strategy over time, looking for trends or patterns in profitability and risk. This can be used to aid in identifying areas where the strategy could require changes.

Examine market conditions: Evaluate the performance of the strategy under various market conditions during the backtesting phase.

Backtesting using various parameters Test the strategy by using different parameters such as methods of risk management or the criteria for entry and exit to test how it works in various situations.

Change the strategy whenever necessary Based on backtesting analysis modify your strategy as necessary to increase performance or decrease the risk.

The results of backtesting requires a careful review of results, performance metrics, risk-management strategies, market conditions, and any other elements that may impact the profitability or the risk of a strategy for trading. If you take the time to carefully look over backtest results, traders can spot areas to improve and adapt their strategy accordingly. View the best look at this for rsi divergence cheat sheet for blog info including robot trading metatrader 5, robot trading 2021, etrade forum, reddit crypto day trading, ig trading forum, automated trading system software, auto trading software for nse, free penny stock chat rooms, kucoin trading, thinkorswim forum, and more.

What Are The Main Differences Between The Online Cryptocurrency Trading Platforms?

There are many differences between online cryptocurrency trading sites, including security. Certain platforms may offer stronger security measures such two-factor authentication and cold deposit of funds. Other platforms may have weaker security which makes them more vulnerable and more vulnerable to theft.

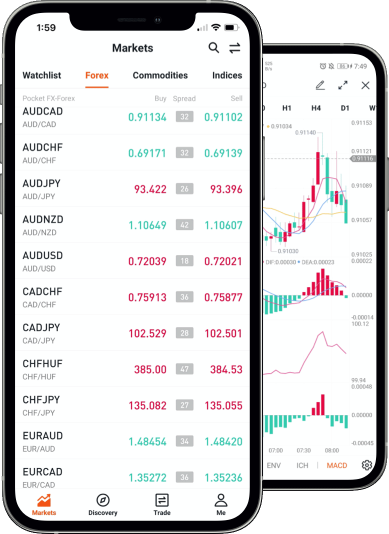

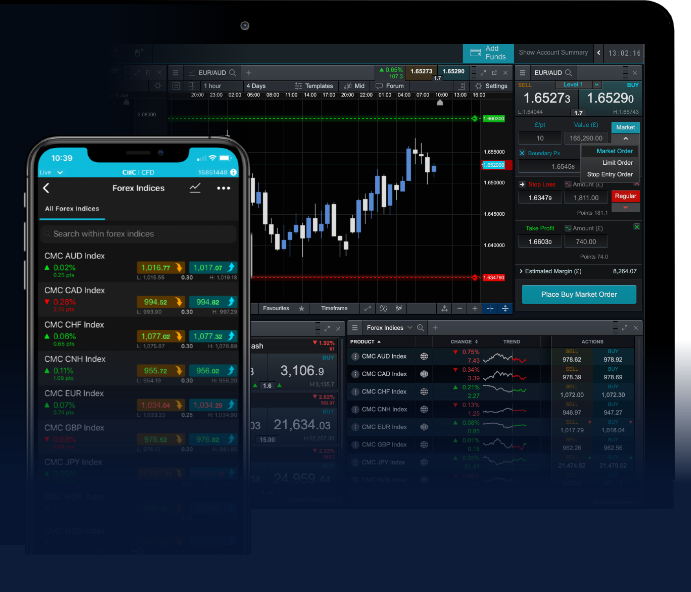

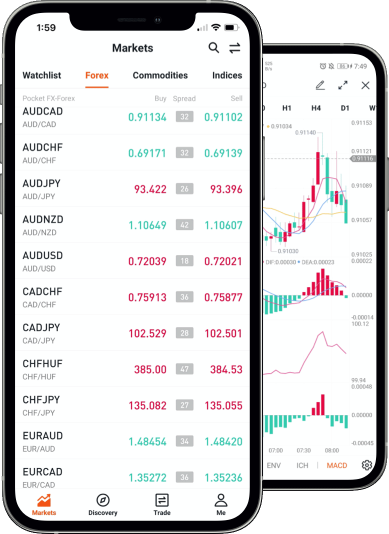

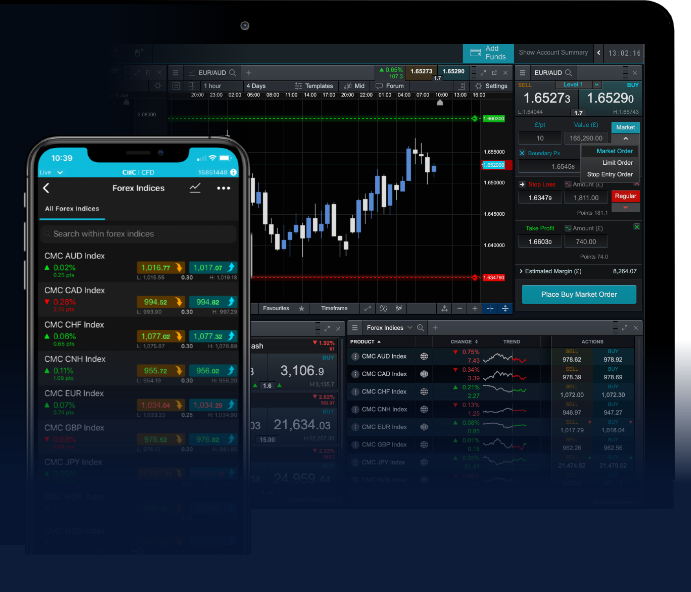

User Interface: The user interface for cryptocurrency trading platforms can vary from simple and straightforward to more complicated and difficult to navigate. Some platforms have more advanced tools and features for trading, and others are geared for beginners.

Fees for Trading: There's many differences between different cryptocurrency trading platforms. Fees for trading can differ between platforms. Certain platforms may charge higher for trading, while other platforms may provide lower prices in exchange for trading options or less trading pairs.

Supported Cryptocurrencies Certain platforms could have more trading pairs available, while other platforms may only support a few of the most popular cryptocurrency.

Regulation: The degree of regulation and oversight can vary widely between cryptocurrency trading platforms. While some platforms have more regulation, others have less oversight.

Customer Support: There are many variables that impact the quality and quantity of customer support offered by cryptocurrency trading platforms. Some platforms may offer 24/7 customer service via live chat or phone and others might offer email support or have limited hours of operation.

There are a variety of key differences in online cryptocurrency trading platforms. Investors must take note of these aspects when selecting an online platform to trade, as they can impact the experience of trading and the amount of risk involved. Follow the top rated crypto trading for site examples including automated day trading strategies, udemy crypto trading, robinhood exchange crypto, top forex forums, poloniex fees, exness forexpeacearmy, wealthsimple trade forum, start crypto trading, software to buy and sell stocks automatically, ninja trader forum, and more.

[youtube]ye3nUsbegGI[/youtube]

Automated crypto trades refer to the application of algorithms or computers for executing trades in the market for cryptocurrency. These programs are designed to adhere to specific rules of trading in order to maximize profits while keeping losses to a minimum.

It is important to choose an automated trading platform that you can be confident about: There are a variety of trading platforms available. It is crucial to choose an automated trading program with a solid track record and is able to meet the requirements of your trading.

A strategy for trading is vital prior to automating your trading. This includes identifying the market conditions in which you want to trade, deciding on exit and entry points, and setting stop-loss order.

Use a risk management system: A good automated trading system will include a risk management system to reduce the chance of losses. This could include placing stop loss orders, and limit the amount of trades that can be made at any given period of time.

Before you implement your strategy for live trading it is essential to test it on previous data. This will help you discover any flaws in your strategy and make necessary adjustments.

Automated Trading System Monitoring: Although automated trading may save time, it is important to keep an eye on the system, and make changes as necessary.

Keep abreast of market conditions. To be successful with automated crypto trading, you must be aware of the market conditions. You can modify your strategy in line with market conditions.

Consider using a diversified portfolio It is possible for cryptocurrency markets to be unstable, and it's possible to have a diverse portfolio of cryptocurrencies , and/or other investments to spread out risk and maximize potential profits.

Overall, successful automated cryptocurrency trading is a result of dependable software, a clearly-defined trading strategy, effective risk management, ongoing monitoring and adjustments, as well as the consideration of a diverse portfolio. Take a look at the most popular backtesting for blog advice including forex robot forum, binance auto sell, shrimpy crypto, free automated trading, binance exchange fees, bybit exchange, kairos automated trading platform, samtrade fx reddit, algo auto trading, options for crypto, and more.

How Do The Automated Trading Software's Cryptocurrency Trading Bots Function?

Following predefined rules, trading robots for cryptocurrency execute trades on behalf users. Here's how it works trading strategy: The user defines the trading strategy that they want to follow, which includes entry and exit rules, position sizing, and risk management rules.

Integration: The bot for trading integrates with an exchange for cryptocurrency via APIs, allowing it to get access to live market data and execute trades.

Algorithms analyze market data to make trading decisions based in part on a particular strategy.

Execution. With no requirement to manually control the process the bot is able to execute trades according to the trading strategy's rules.

Monitoring: The robot continuously analyzes market activity and changes trading strategies according to the need.

The use of trading robots for cryptocurrency is beneficial when executing complex or routine trading strategies. This makes it less necessary to intervene manually and allows traders to profit from market opportunities 24 hours a day. It is important to recognize that automated trading has its own set of risks, including the potential for software malfunctions as well as security flaws, as well as losing control over trading choices. Before you decide to use any bot to trade live trading, it is important to fully evaluate and test it. Follow the top crypto trading bot tips for more examples including forex and crypto, tastytrade forum, automated fx, elite traders reddit, cheapest fees crypto exchange, best autotrading platform, crypto spot, primexbt welcome bonus, ninjatrader 8 automated trading strategies, best forex robots mt4, and more.

What Is The Crypto Trading Backtester? How Do You Use It In Your Strategy?

The backtester for crypto trading allows you to test your strategy for trading against the historical prices in order to see how it has did over time. It is a useful tool for evaluating the effectiveness of a trading strategy , without placing a bet on money.To include a cryptocurrency backtester for trading into your strategy, you should take these steps:

Select a site for backtesting There are a variety of platforms that allow you to backtest strategies to trade with crypto. These include TradingView (Backtest Rookies), TradingSim, and TradingSim. Select the best platform for you and your budget.

Define your trading strategy Before you are able to back-test your strategy you must define the guidelines you'll apply to entering and exiting trades. This could include indicators of technical nature such as moving averages, Bollinger Bands, or RSI in addition to other criteria like trading volume, news events, or sentiments on social media.

Start the backtest. After you've created your trading plan, it's possible to setup the test on the platform you prefer. This requires you to select the cryptocurrency pair you'd like to test and the time period you want to test it, and any other parameters related to your plan.

To determine how your trading strategy worked over time, run the backtest. Backtesters will produce reports that detail the outcomes of trades including profit and losses, loss/win ratios, and other metrics.

Examine the results: You can analyze the results following the test to find out how your strategy performed. The backtest results can help you adjust your strategy to increase its effectiveness.

Test the strategies forward: After making any adjustments to the strategy, you can test it forward strategy using an example or a small amount of real money. The method will then work in real-time trading conditions.

By incorporating the backtester for crypto trading into your strategy, you can gain valuable insights into how your strategy might have performed in the past and then apply this knowledge to improve your trading strategy going forward. View the top best trading platform tips for site recommendations including 3commas indicators, pepperstone automated trading, best trading forums reddit, shiba coin exchange, cryptocurrency trading sites, free day trade chat rooms, mt4 forum forex, best crypto trading platform reddit, best platform for crypto, fibonacci cryptocurrency, and more.

How Can You Evaluate The Results Of Backtesting To Assess The Risk And Profitability Associated Trading Strategies?

Analyzing the results of backtesting will help you determine the profit and risk associated to a trading strategy. Here are some steps to follow when analyzing backtesting results Determine performance metrics The first step to take when analysing backtesting results is to determine key performance indicators like the return on investment, average return, maximum drawdown, and Sharpe ratio. These metrics give insight into the risk and profitability associated with the strategy of trading.

Comparing to benchmarks. A comparison between the benchmarks and performance indicators (e.g. the S&P 500) can be an excellent reference point to see how the strategy has performed relative to the other markets.

Evaluate risk management practices Examine the risk management strategies that are employed within the trading strategy such as stop-loss orders or positioning sizing to determine their efficiency in reducing loss.

Find trends: Examine the effectiveness of the strategy over time, looking for trends or patterns in profitability and risk. This can be used to aid in identifying areas where the strategy could require changes.

Examine market conditions: Evaluate the performance of the strategy under various market conditions during the backtesting phase.

Backtesting using various parameters Test the strategy by using different parameters such as methods of risk management or the criteria for entry and exit to test how it works in various situations.

Change the strategy whenever necessary Based on backtesting analysis modify your strategy as necessary to increase performance or decrease the risk.

The results of backtesting requires a careful review of results, performance metrics, risk-management strategies, market conditions, and any other elements that may impact the profitability or the risk of a strategy for trading. If you take the time to carefully look over backtest results, traders can spot areas to improve and adapt their strategy accordingly. View the best look at this for rsi divergence cheat sheet for blog info including robot trading metatrader 5, robot trading 2021, etrade forum, reddit crypto day trading, ig trading forum, automated trading system software, auto trading software for nse, free penny stock chat rooms, kucoin trading, thinkorswim forum, and more.

What Are The Main Differences Between The Online Cryptocurrency Trading Platforms?

There are many differences between online cryptocurrency trading sites, including security. Certain platforms may offer stronger security measures such two-factor authentication and cold deposit of funds. Other platforms may have weaker security which makes them more vulnerable and more vulnerable to theft.

User Interface: The user interface for cryptocurrency trading platforms can vary from simple and straightforward to more complicated and difficult to navigate. Some platforms have more advanced tools and features for trading, and others are geared for beginners.

Fees for Trading: There's many differences between different cryptocurrency trading platforms. Fees for trading can differ between platforms. Certain platforms may charge higher for trading, while other platforms may provide lower prices in exchange for trading options or less trading pairs.

Supported Cryptocurrencies Certain platforms could have more trading pairs available, while other platforms may only support a few of the most popular cryptocurrency.

Regulation: The degree of regulation and oversight can vary widely between cryptocurrency trading platforms. While some platforms have more regulation, others have less oversight.

Customer Support: There are many variables that impact the quality and quantity of customer support offered by cryptocurrency trading platforms. Some platforms may offer 24/7 customer service via live chat or phone and others might offer email support or have limited hours of operation.

There are a variety of key differences in online cryptocurrency trading platforms. Investors must take note of these aspects when selecting an online platform to trade, as they can impact the experience of trading and the amount of risk involved. Follow the top rated crypto trading for site examples including automated day trading strategies, udemy crypto trading, robinhood exchange crypto, top forex forums, poloniex fees, exness forexpeacearmy, wealthsimple trade forum, start crypto trading, software to buy and sell stocks automatically, ninja trader forum, and more.

[youtube]ye3nUsbegGI[/youtube]

Who is online

Users browsing this forum: No registered users and 4 guests